Exploring the world of insurance can sometimes feel like trying to solve a puzzle. With so many options available, it’s essential to find one that not only offers protection but also provides added benefits. That’s where Money Back Insurance Plans come into play, especially in Canada, where financial security and savings are a priority for many families. But what precisely are these plans, and how do they function? Let’s dive into the basics of Money Back Insurance Plans, making it as simple as pie to understand.

What is a Money Back Insurance Plan?

A Money Back Insurance Plan is a type of policy that does more than just offer protection—it promises to return a portion of the premiums you’ve paid over the term of the policy. Think of it like a savings account that also offers you insurance coverage. You put money in (through your premiums), it provides you with financial protection, and then, after a certain period, it gives you money back. It’s a win-win situation where you get the best of both worlds: security and savings.

How Do Money Back Insurance Plans Work?

Understanding how Money Back Insurance Plans work is crucial to seeing their value in your financial planning. Let’s delve deeper into this concept through a listicle that straightforwardly explains the workings:

Initial Setup and Premium Payments: When you sign up for a Money Back Insurance Plan, you agree to pay regular premiums over a specified term, say 20 or 25 years. These payments can be monthly, quarterly, semi-annually, or annually, depending on the policy.

Periodic Survival Benefits:Unlike traditional insurance policies that only pay out upon the policyholder’s death, money back plans start returning a portion of the premiums at predetermined intervals throughout the policy’s life. This could be every 5 or 10 years.

Percentage of Premiums Returned: The plan specifies what percentage of the premiums paid will be returned as survival benefits. This can vary but is typically a set percentage of the total premiums paid up to that point.

Final Maturity Benefit: At the end of the policy term, if the policyholder is still alive, they receive a final maturity benefit. This amount includes the last installment of the survival benefits plus any additional bonuses or guaranteed sums specified by the policy.

Death Benefit: In the event of the policyholder’s untimely death during the term, the beneficiaries receive a death benefit. Importantly, this amount is not reduced by the survival benefits already paid out, ensuring the policy’s full coverage amount is available to support the policyholder’s loved ones.

Tax Benefits: Money back plans often come with tax benefits. The premiums paid may be tax-deductible, and the survival benefits and maturity proceeds received are usually tax-free, enhancing the plan’s overall value.

Flexibility for Financial Planning: The periodic payouts provide a unique opportunity for financial planning. These funds can be reinvested, saved for future expenses, or used to cover current financial needs, offering a blend of long-term savings and immediate financial flexibility.

Find Out: Do you get Money-Back from Term Life /insurance?

The Benefits of Money Back Insurance Plans

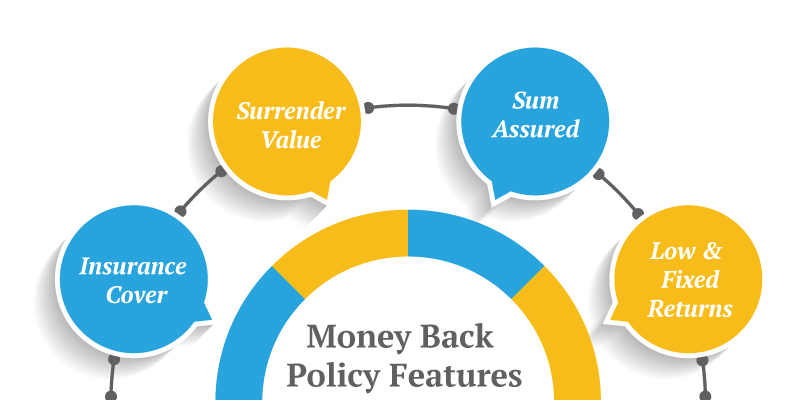

The main attraction of Money Back Insurance Plans lies in their dual benefit: protection plus savings. Here’s why they can be a smart choice:

- Guaranteed Returns: Periodic payments offer a guaranteed return on a portion of your premiums, which can be especially appealing for those who like to plan their finances with certainty.

- Financial Protection: While offering returns, these plans also provide a safety net for your loved ones in case something happens to you, ensuring they are financially taken care of.

- Flexibility: The money received back can be used for various purposes, like funding education, a wedding, or even investing in other opportunities. It’s your money to spend as you see appropriate.

Money Back Term Life Insurance: A Closer Look

When we talk about “Money Back Term Life Insurance,” we’re referring to a specific type of money back plan that combines the benefits of term insurance with the promise of premium returns. Unlike traditional term life insurance, which does not return your premiums if you outlive the policy, Money Back Term Life Insurance ensures that you get something back if you’re still around when the policy ends. This feature makes it an attractive option for those who want the security of term insurance but are hesitant about the idea of “wasting” premiums on a policy that might never pay out.

Who Should Consider Money Back Insurance Plans?

Money Back Insurance Plans are not a one-size-fits-all solution, but they can be particularly beneficial for:

- Families with specific financial goals: If you have clear milestones you’re saving for, the periodic payouts can help you reach those goals.

- Individuals looking for a combination of savings and protection: For those who want the peace of mind that comes with life insurance, coupled with the practical benefit of getting money back.

- Conservative investors: If you prefer investments with guaranteed returns, the predictable nature of money back plans can be appealing.

How to Choose the Right Money Back Insurance Plan

Choosing the right plan involves considering your financial needs, goals, and the policy’s terms and conditions. Here are a few tips:

- Understand the Payout Schedule: Look at how often and how much you’ll receive in survival benefits. Make sure it aligns with your financial planning.

- Compare Coverage: Ensure the life insurance coverage is adequate for your needs. Don’t let the allure of money back distract you from the primary purpose of insurance.

- Check the Premiums: Assess whether the premiums are affordable and worth the benefits you’re receiving. Remember, these plans can be more expensive than straightforward term insurance because of the money-back feature.

Final Words

Money Back Insurance Plans offer a unique combination of benefits, making them an intriguing option for those looking for more from their life insurance policy. By providing both a safety net for your loved ones and a mechanism for savings, these plans cater to a range of financial strategies and goals. Whether it’s Money Back Term Life Insurance or another type of money back plan, the key is to find a policy that matches your specific needs and financial outlook. With the right plan in place, you can enjoy the peace of mind that comes with knowing you’re protected, while also looking forward to the financial returns that await you down the road. In the landscape of insurance options, money back plans shine as a beacon for those who value both security and savings.Get in touch with insurance experts for more knowledge on the subject.